Decrease in Payables Cash Flow

This journal entry will decrease the accounts payable debit as a result of paying our debt. To calculate it multiply the days in the period by the ratio of accounts payable to the cost of revenues within the same period.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

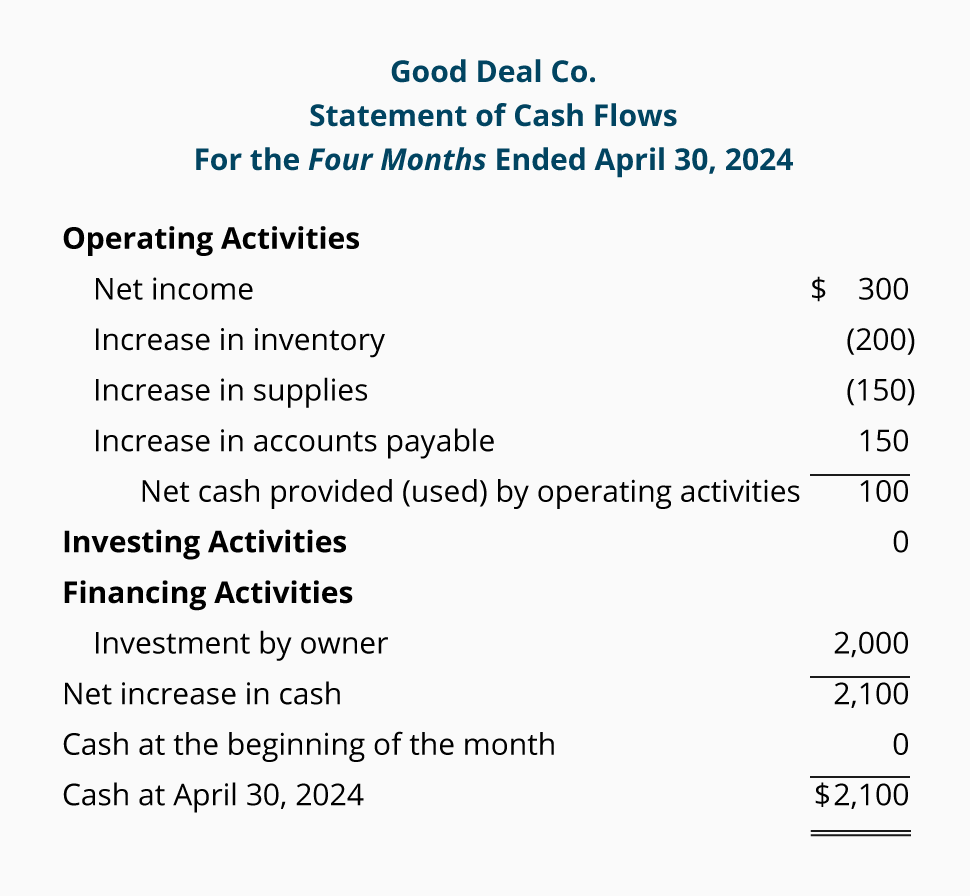

Cash Flow Statement What It Is And Examples

During that same quarter the company makes a 300 payment towards the loan principal.

. When a company purchases goods on account it does. Different terms for accounts payables are agreed upon by different vendors. According to the statement of cash flows a decrease in.

Finance questions and answers. For example consider a consulting firm that takes out a 150000 loan in quarter one. Use e-signature platforms and take advantage of the document management modules offered by your accounting software.

However this will lead to a decrease in cash balance credit as a result of cash outflow from. Typical example would be vendor supplying goods on credit to a. Increase in Account Payable 35000.

Decrease in trade payables. Dont override it just because youre the boss. Statement of Cash Flows.

Up to 10 cash back Most businesses prepare an accounts payable aging schedule at the end of each month. An increase in accounts payable indicates positive cash flow. You can use this information to improve the operation of your.

Understanding your biggest uses of cash is the first step in aligning your spending with your true needs. If you find a decrease in the days payable outstanding your. Account Payable 35000-70000.

While increase in current assets and decrease in current liabilities are. A typical accounts payable aging schedule consists of 6. Accounts payable is the sum of money owed to suppliers and creditors by a business.

The reason for this comes from the accounting nature of accounts payable. So it means that there are net amount credit sales for which we have not received any cash amount. An Increase in Accounts Payable is Favorable for a Companys Cash Balance It may help to view the positive amounts on the SCF as being favorable or good for a companys cash balance.

It represents the current liability on the balance sheet and operating activity on. The larger cash payments have been. Accounts payable sit in companys balance sheet for the simple reason that cash was not paid but is owed.

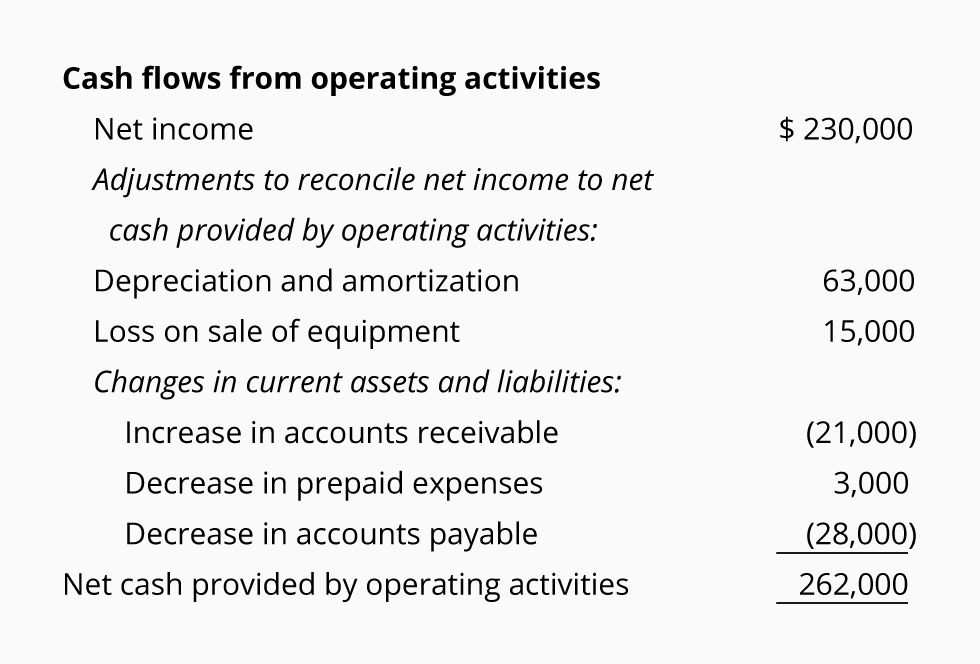

A decrease in accounts payable will also represent a decrease in a companys statement of cash flows. Under Indirect method we add back the decrease in current assets and increase in current liabilities. A decrease in trade payables occurs when cash paid to suppliers is greater than cash and credit purchases.

Answer 1 of 7. For this reason a decrease in accounts payable indicates negative cash flow. Managing accounts payable to improve cash flow.

These accounts payables may be payable in 30 60 or 90 days depending on the creditability of the company. The Business Cash Flow Tool can help to forecast the impact. Companies may list a decrease and an increase in accounts payable.

Statement Of Cash Flows Indirect Method Change In Accounts Payable Youtube

Understanding Cash Flow Statement Finance Train

No comments for "Decrease in Payables Cash Flow"

Post a Comment